How COVID-19 is changing current and future consumer digital behavior around the world

Across the globe the COVID-19 pandemic and subsequent lockdowns have dramatically changed the everyday behavior of billions of people. It has had a particular impact on digital channels, with people switching to online given that many shops have been closed and consumers forced to stay at home.

What will the long-term impact be? Will people return to offline channels or has the crisis accelerated the move to digital? What does this mean for brands and their strategies, particularly around personalizing the online experience?

To find out Kameleoon worked with members of global experimentation agency network the Go Group Digital to carry out an in-depth survey into digital consumer trends - now and in the future.

We surveyed 5,000 consumers in the US, UK, Germany, France and Italy at the beginning of May 2020.

Analyzing the results we can see five clear conclusions:

1 An immediate increase in use of digital channels after the COVID-19 crisis begins

Looking at activities such as shopping, media, elearning, finance and healthcare, over a third of those we surveyed globally (34%) are doing more online.

Are you spending more time online?

The biggest increases in online activities

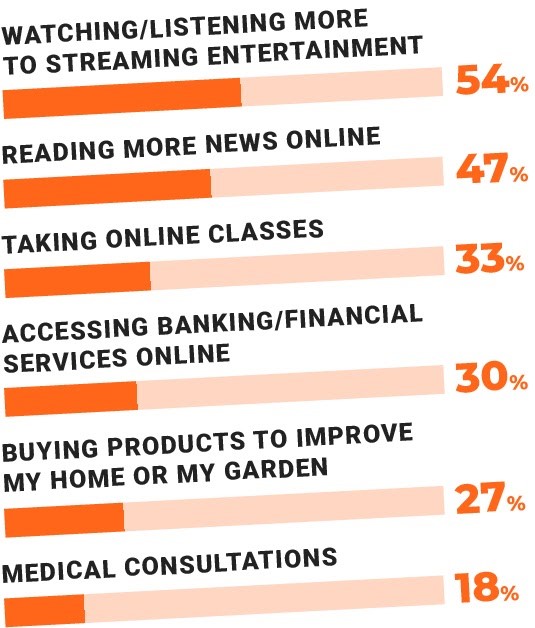

Consumers are using digital channels more for a wide range of digital tasks:

- Watching and listening to streaming entertainment, with 54% of consumers doing this more. In fact 11% said they’d doubled the time they spent on digital entertainment.

- Reading the press (47% of consumers doing this more) - unsurprising given desires to keep up with news around the pandemic and its impact.

- A third of people (33%) were using more of their enforced leisure time to take online classes

- 27% were buying products to improve their home or gardens.

What activities are you now doing more online?

Wide local differences

There were substantial variations between countries however, driven by the scale and severity of the lockdown and underlying levels of digital maturity. In Italy more stringent stay at home regulations meant people were spending 43% more time online, with 69% watching more streaming entertainment. In Germany by contrast 24% of consumers were online more, thanks in part to a less strict lockdown.

2 Digital increases are here to stay after COVID-19 lockdowns end

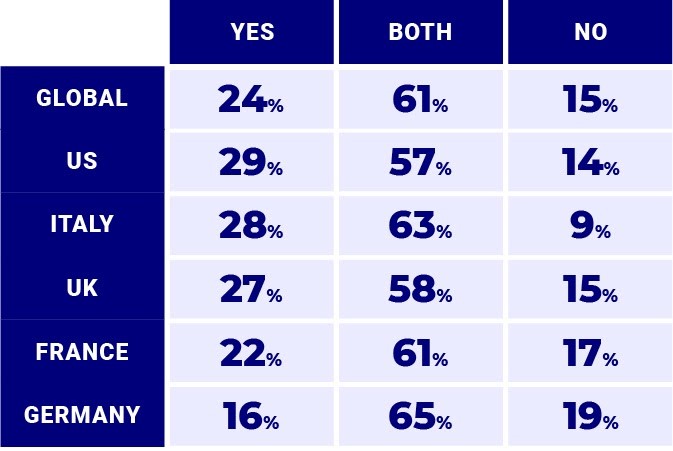

The pandemic and lockdowns have changed digital consumer behavior for the long-term, rather than just for the length of the crisis. Nearly a quarter (24%) of people said they’d do more on digital channels when lockdowns were relaxed, with the highest figures in the US (29%) and Italy (28%). 61% of global respondents said they’d use both channels dependent on their situation, and just 15% said they switch back to mostly using offline channels.

Will you use digital channels more long-term or switch back to offline?

The global digital outlook

This points to an enormous opportunity for brands - with consumers increasingly using digital they have the chance to significantly boost online revenues and engagement, provided they can deliver the experience that consumers require. With a wider range of demographic groups online, ensuring that every website visitor receives a personalized, seamless experience is ever-more vital.

Understanding local cultural differences

Future adoption of digital shows substantial variations between countries, meaning that brands need to adapt their experience to overcome concerns, particularly amongst those new to digital channels.

This is shown by the numbers saying they’d use digital channels more:

- US 29%

- Italy 28%

- UK 27%

- France 22%

- Germany 16%

3 Brands letting consumers down when it comes to a personalized experience

With digital now being the default channel for the majority of consumers, the experience that brands provide is vital if they are to engage with their visitors, build trust and create long-term revenues. However, our study shows that many brands are failing to deliver the personalized experience that consumers demand.

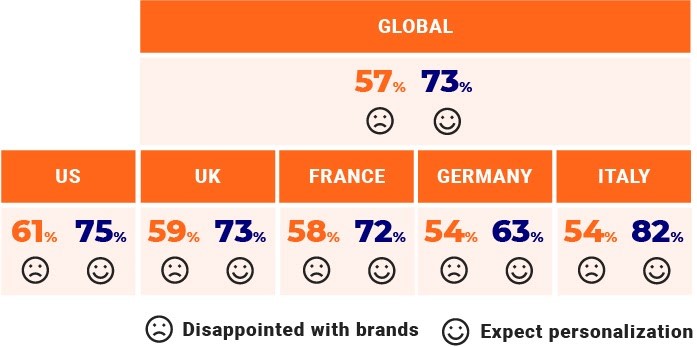

The desire for personalization

Consumers overwhelmingly want personalization. 73% said they expect a personalized journey when they interact with brands digitally and 80% expect personalized emails. Nearly four in ten consumers (40%) want websites to adapt to their needs and expectations, rising to 52% of those in the US.

The personalization gap

While consumers are open to personalization, they don’t feel that all brands are providing it:

- 57% say that they are disappointed with the response from some or all brands

- Just 25% said brands were customizing their digital experience to their personal needs.

Essentially consumers feel that brands are delivering a minimal level of tailoring and reassurance during the crisis, missing out on the opportunity to offer relevant products, services and deals to help them.

Consumer attitudes to personalization

4 The impact of the experience on future purchases

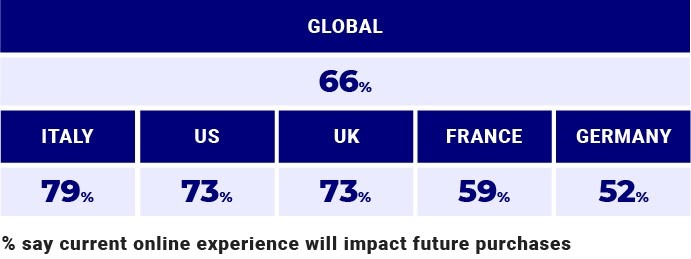

The study demonstrates a clear link between the quality of the digital experience currently being delivered and future buying behavior:

- Two-thirds (66%) said it would change who they bought from

- 41% will spend less or switch from brands that have not delivered on their needs at the current time

- On the positive side 21% will buy more from brands that have delivered a good, personalized experience

How will the current online experience impact your future purchases?

All of this shows that brands need to demonstrate that they are taking care of customers and providing a reassuring, positive experience on digital channels - otherwise they will lose out to competitors in terms of future revenues.

The international buying gap

Italians were the most likely to change who they bought from, and how much they spent, based on the current experience they received. 79% of Italian consumers said it would impact their future purchasing behavior, ahead of the US and UK (73% each). 50% of British consumers said they’d spend less with brands that had disappointed them, against 39% of French consumers, who were amongst the most loyal to poorly-performing brands, with 41% still buying from them. Only German consumers (49% loyalty) were more likely to stick with such brands.

5 The benefits of switching to digital

What benefits do consumers see in adopting digital channels? Understanding this is vital if brands are to provide the service and experience that best meets their needs and to therefore cement the switch to digital.

The Global Savings vs Time divide

Overall most consumers saw the principal benefit of digital as saving money (26%), ahead of saving time (24%). Analyzing at a local level, while price was paramount in the US, UK and Italy, in Germany and France saving time was most important.

Attitudes to digital privacy

Clearly consumers want their personal data to be protected online and not to be misused by brands. However, the study shows that the benefits of digital (saving money, time and delivering greater choice) ranked way above having their personal data tracked by brands. Only 9% saw being tracked as the most important element of digital - and 40% ranked it as the least important.

Our research contains an enormous amount of data and valuable learnings for brands. Therefore we are creating an in-depth study, in conjunction with the Go Group Digital, that drills down into the findings and provides clear, best practice guidance on how brands should adapt their digital strategies to the future needs of consumers. Pre-register for your copy here.