4 digital key challenges for financial services - and how experimentation and personalization overcome them

The rise of digital is transforming the financial services industry, bringing new challenges to existing players and new entrants alike. Successfully managing the change to a digital-first, customer-centric model is vital for long-term revenue growth, but requires different approaches from banks, insurers and other financial institutions.

1 Outlining the key digital challenges for financial services

From talking regularly to clients in the sector, we see that brands in the banking and finance industry currently face four key challenges:

Greater competition from a wider range of banks

Digitization and deregulation has opened up markets to a wide range of new players, from technology-driven fintech startups to existing consumer brands that are widening their portfolio. Due to their size and focus these companies can often operate in an extremely agile, fast-moving way - more like a tech company than a traditional bank.

By focusing on digital-first these startups are ahead when it comes to delivering a seamless online experience, meaning that traditional banks can lag behind. This increases the risk of churn for many incumbents and highlights the need to cross-sell and upsell a greater range of products.

Changing banking customer expectations

The old model of consumers remaining loyal to their bank or insurer without question is very much in the past - as is the idea that the majority of contact and interactions takes place face-to-face in branches or offices.

During the COVID-19 pandemic 30% of global consumers said they were spending more time accessing banking and financial services online for example. Today’s consumers want a high-quality, digital-first experience that brings together the individual attention they would receive from a bank manager or insurance agent with the ease, simplicity and control of online and mobile channels. Being able to scale this tailored experience across multiple channels and to a wide range of customer types is crucial, but difficult to deliver for many traditional players.

Increased banking industry regulations

The legacy of the banking crisis has been an increase in regulations that banks in particular need to comply with in terms of how they sell to customers and treat them fairly. Given the nature of the financial and personal customer information they hold protecting this data is clearly vital.

As well as legislation such as the Payment Card Industry Data Security Standard (PCI DSS), as with all consumer-facing organizations, financial services brands have to meet data privacy and protection requirements, such as the GDPR and CCPA. Compliance with stringent data regulations are vital, not just to avoid fines but to deliver reassurance and build trust with consumers.

Pressure on margins

Even before COVID-19 the world was in an unprecedented era of low interest rates. This limits the ability of banks and insurers to invest in the technology and processes they need to embrace digitization and become more customer-centric, as described in this OECD report. The likely increase in bad debts caused by the pandemic and recession will further increase this pressure.

2 Overcoming key challenges through digital experimentation and personalization

These challenges impact the digital marketing of financial services companies in four main ways:

- They need to move to anomnichannel approach that successfully qualifies leads that are then sent to offline channels, such as branches.

- They need to identify when customers and prospects are going through milestone events (such as starting a family or getting married) and then provide the right support and services at that point

- They have to reduce online churn

- They have to successfully capturing new customers the first time they visit their website

The positive news for all companies in financial services is that embracing digital marketing provides the ability to meet the challenges we’ve described - here’s how experimentation, segmentation and AI-driven personalization can help.

Being more proactive and agile through experimentation

With digital becoming the channel of choice for many the online experience brands offer has become a key point of differentiation. This is particularly true in financial services when other factors, such as the interest rates offered, are similar, meaning they have less weight in buying decisions. Delivering a seamless experience to all requires constant improvements to ensure every factor - from content to navigation - within the customer journey meets consumer expectations if banks and insurers are to reduce churn and increase revenues.

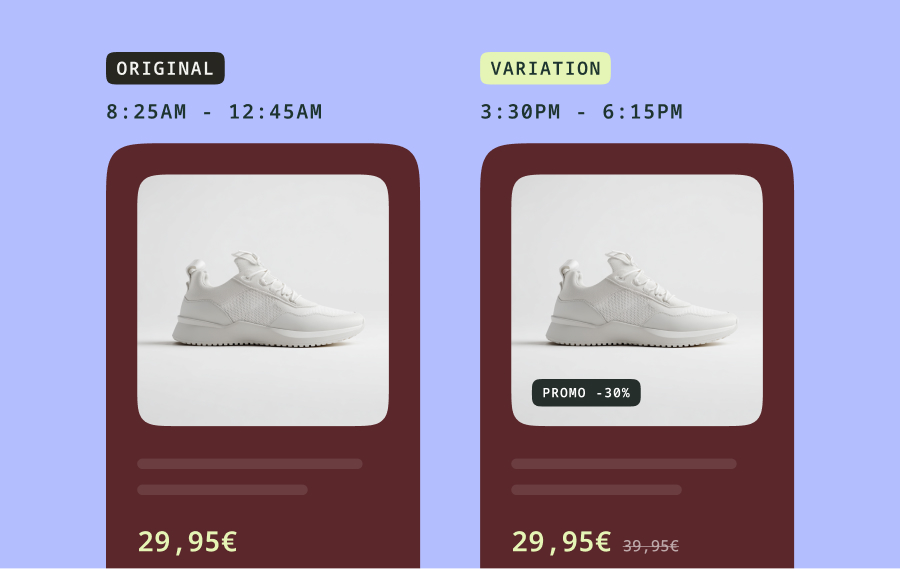

Adopting a culture of experimentation where everything is questioned and tested is therefore vital. This allows brands to make decisions based on reliable evidence, rather than hunches, and delivers the high-quality experience that consumers require. While creating this culture within traditional, hierarchical organizations can be difficult, it is possible - and the pandemic provides a catalyst for change. This blog outlines some of the steps you can take to create a culture of experimentation in your organization.

As well as driving improvements, experimentation can be used to test new concepts - both online and offline. For example, you can see whether new offers and products appeal to consumers before going to the time and expense of a full launch, reducing the chances of failure and maximizing ROI.

Segmentation to better meet customer needs

Financial services companies have always catered for a broad range of consumers, with different demographics, needs and interests. Lockdowns during the pandemic meant that many customers switched to digital channels for the first time, and our research shows that many will remain online.

This increases the pressure to deliver a tailored experience to all of these different groups. For example those looking to buy their first home aren’t going to be interested in the latest offers on car insurance, while teenagers won’t (yet) be in the market for a pension. This means being able to segment visitors to your website is vital - using the data you have on your customers and their needs to ensure they see appropriate content and offers is crucial to engagement and interesting them in relevant products and services.

AI-driven personalization to offer tailored experiences

Segmentation enables financial services companies to provide a broadly tailored experience to consumers, based on the needs of others with the same demographic profile. However, customers want to be treated as the individuals they are if they are to remain engaged customers. For example, 89% of respondents in research from Epsilon said they were more likely to buy from a financial brand that offered them a personalized experience.

Financial institutions therefore need to be able to deliver tailored products and services based on not just demographics, but the actual behavior of consumers on their website. Understanding the micro-signals that they provide (such as the pages they look at and navigation they follow) provides thousands of clues that would be picked up in a face-to-face meeting with a bank advisor, but are much more difficult to analyze and react to in real-time online.

Adopting AI-powered personalization technology gives financial services companies the tools to deliver this individual experience, in real-time, at scale. By analyzing customer behavior and comparing it to those of previous visitors, AI can predict what people are looking for and immediately offer them what they need to move down the buying funnel. For example, it can help predict milestone life events, such as getting married or starting a family, and suggest relevant information and products. For new visitors where financial brands don’t have any existing data it can help increase conversions by delivering a tailored experience and offers, based on their initial behavior on the site.

Embracing a digital future for financial services

The pandemic has accelerated a number of trends in the financial services sector, such as the move to digital channels and the rising level of customer expectations. With competition also increasing, the brands that thrive will be those that adopt experimentation and personalization across their operations in order to deliver the individual experience that consumers demand.