3 key findings about CX and optimization in finance

Banks have enough data to make exceptional digital experiences for their customers. However, they can't seem to apply it.

What's stopping retail banks from optimizing CX with the mountains of information they collect?

Forrester surveyed 107 banking executives from North America about optimization and data in banking. The research agency found that fear and confusion prevent most from using data to deliver the experiences their customers want.

Only one subset of banks—those with mature data governance strategies—knows what kind of data is actually risky.

The report provides strategies banks can take to become customer-centric, digital-first leaders —which is what their customers want.

When banks figure this out with a data governance strategy, they grow. In fact, they grow 3.1x faster than those that don’t use data for CX optimization.

Here are the key takeaways:

1 Banks can optimize the customer experience without violating privacy regulations

Seven out of 10 banks said they collect CX data from digital interactions with their users.

Yet, only 4 out of those 7 banks (or 59%) analyze that data to generate insights. Most are not applying customer data to optimize experiences.

According to respondents, the biggest challenge preventing banks from using data to inform great customer experiences was "concern about customer privacy."

While banks might have good intentions, the report is clear in its conclusion: Banks can use several high-reward, low-risk UX strategies to pull ahead of their competitors.

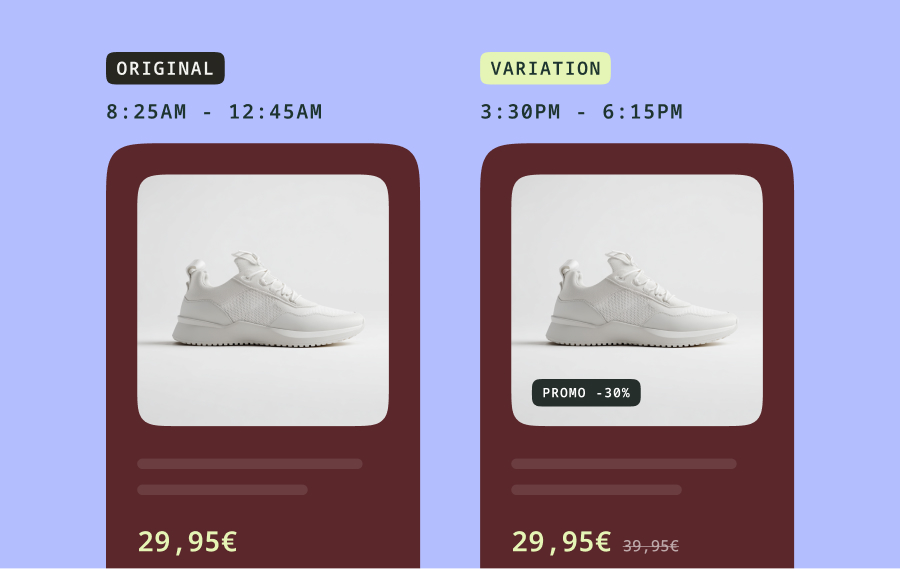

They can also use A/B testing and optimization tools that are compliant with data privacy regulations.

2 A mature data governance strategy is the cornerstone of growth and optimization

A mature data governance strategy involves defining, executing, training, and overseeing compliance.

In other words, before starting a program of experimentation or A/B testing, you must first decide what data you will use, your goals, and how you plan to keep your data safe. This involves segmenting anonymous, pseudonymous and personally identifiable data, among other things.

But, banks tend to lump all types of data together—which becomes one of the main hurdles to optimization.

More mature data governance fixes this problem, as not all data is not created equal, at least in the eyes of regulators.

"Understanding the difference between various forms of data will help to overcome bottlenecks in order to improve CX that relies on anonymous data, which carries little risk," said the report.

Yet, only 38% of retail banks surveyed described their data governance strategy as "very mature."

3 The right technology is crucial for successful CX for banks

According to the report, successful banks focus on three key areas to begin optimizing pools of data to provide better CX: 1) technology (64%); 2) processes (59%); and 3) skills (34%).

Each of these was cited as a core competency to advancing digital customer experience initiatives.

But what exactly makes a tool or technology right for CX?

For banks, the right kind of tech must have robust security and privacy features and securely link to the bank's data and analytics tools.

By putting technology—plus processes and skills—at the heart of CX strategy, banks can leverage advanced techniques to get deeper into customer behaviours, motivations, and attitudes. This includes rule-based targeting and optimization, and profile-based targeting and optimization.

"Retail banks striving to join the ranks of fast-growing, advanced insights-driven businesses can double down on their data management strategy in order to improve their optimization capabilities," said the report.

"However, the majority of retail banks in our survey are failing to connect the dots."

Indeed, only 64% of respondents said their organization can measure the impact of their digital CX strategy.

For banks that consistently apply A/B testing and experimentation best practices with the right tools, the potential to differentiate themselves from the competition is tremendous.